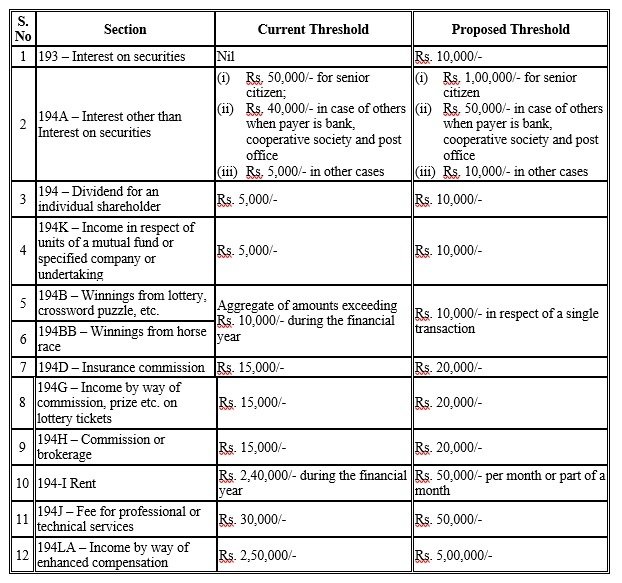

The Finance Bill 2025 introduces significant rationalization of Tax Deducted at Source (TDS) thresholds to simplify compliance and enhance clarity for taxpayers. The new thresholds aim to streamline TDS processes and reduce administrative burdens.

Key Changes Proposed in TDS Thresholds

Other Proposed Changes :

- Section 206C(1G) – The threshold for remittance outside India under the LRS scheme is proposed to be increased from ₹7 lakh to ₹10 lakh.

- Section 206C(1G) – TCS on remittance outside India under the LRS scheme for specified education loans is proposed to be removed.

- Section 206C(1H) – TCS on the sale of goods is proposed to be removed.

- Sections 206AB and 206CCA – The higher TCS rate for non-filers of income tax returns is proposed to be abolished.

- Section 276BB – No prosecution proceedings will be initiated if TCS is paid before return filing.

These changes, effective from April 1, 2025, will provide greater clarity for taxpayers and streamline tax deduction and collection processes. Businesses and individuals should review these updates to ensure compliance and take advantage of the revised limits.